Or b in any other case shall be deemed to be salary or wages income taxable at the rate declared by Section 13 of the Income Tax Salary or Wages Tax Rates Act 1979. Also there are different specializations available for candidates to choose from like Labour Law Commercial Law Business Law Corporate Law Criminal Law Cyber Law and Environment Law.

Your Step By Step Correct Guide To Calculating Overtime Pay

The labour and employment law in India is also known as Industrial law.

. Find the number of working days in the current month. According to the section-10 of Payment of Bonus Act 1965 it is an employee right drawing salary of Rs. MrAbhay posed a few questions.

The minimum obligatory annual increase is set at no less than 7 of the basic salary which is the basis for calculation of social insurance. Gaslighting manipulation and grift. The Employer may deduct from the service gratuity any amount that the Worker owes him.

The industriallabour-law enacted by the British was meant primarily to protect the British employers interests. The calculation of the gratuity shall be based on the Workers last Basic Wage. Many others are feeding useful information.

7000- for calculation of bonus and it is the duty of the employer to pay minimum bonus to their employees irrespective of profit or loss to an. MsHansa presented an easy to. Considerations of the British.

Labour MPs shouted we must Support the troops our boys and girls in uniform once they had crossed the border irrespective of the known lies. Some of the core job profiles in law include. In practice a flat rate of 167 is applied in respect of foreign employers.

The minimum premiums are set at 35 of the normal pay for overtime work during daylight and 70 for work at nighttime. 245 of total gross salary. To claim for payment of minimum bonus that is 833 of his salary his her salary will be treated as maximum Rs.

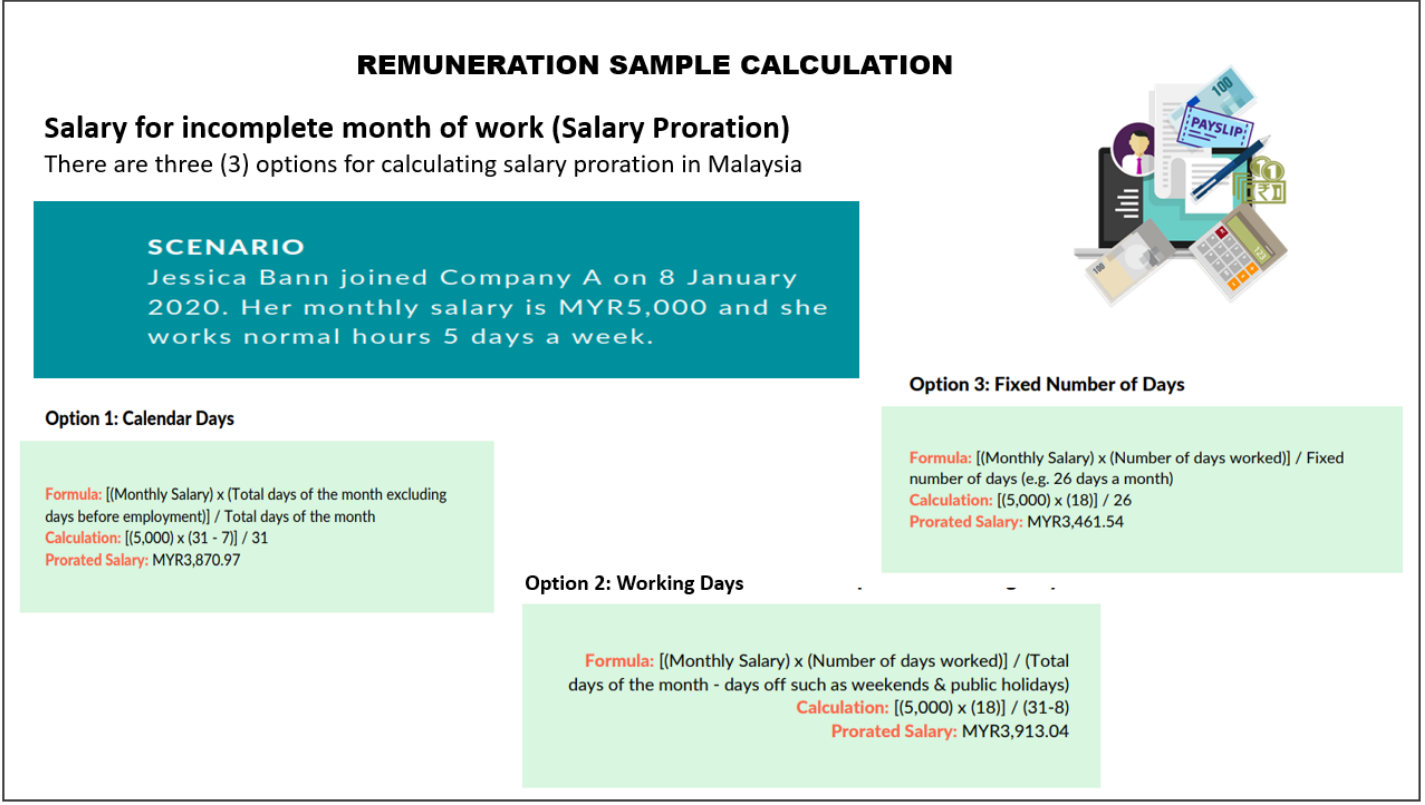

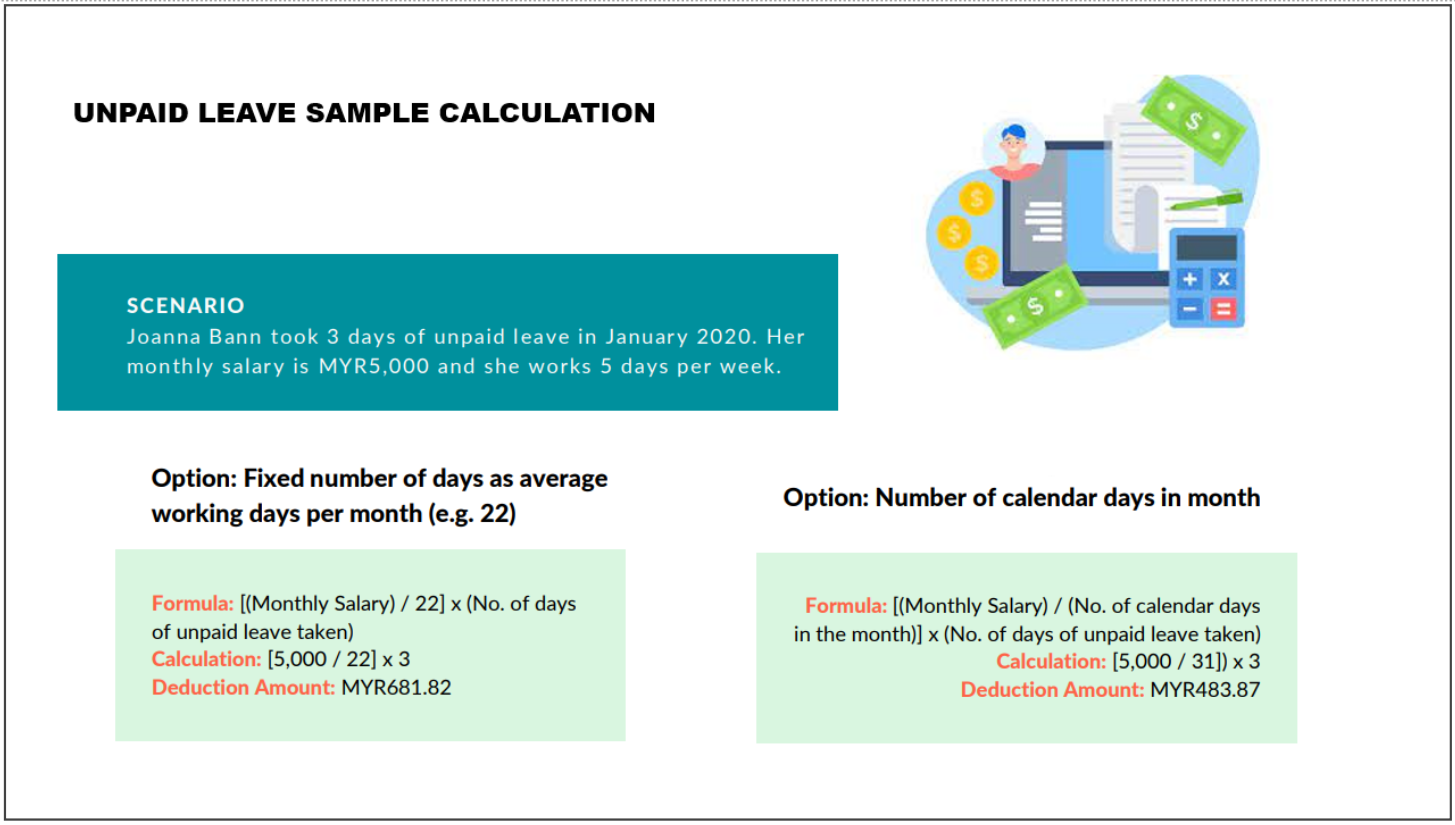

Manual calculation of unpaid leave. 15 of 2017 on Domestic Workers. Domestic servant means a person employed in connection with the work of a private dwelling-house and not in connection with any trade business or profession carried on by the employer in such dwelling-house and includes a cook house-servant butler childs nurse valet footman.

MrDipil tried to answer one by one. Multiply this number by the total days of unpaid leave. The call for emotional loyalty to a.

The great majority of the international trade is done within the European Union EU whose countries received 728 of the Portuguese exports and were the origin of 765 of the Portuguese imports in 2015. The economy of Portugal is ranked 34th in the World Economic Forums Global Competitiveness Report for 2019. Under Section 35 of the Employment Act 2007 Service pay is the amount of money paid to an employee by an employer whose contract of service to pay wages periodically at intervals of one month or.

100 for work performed on days off and holidays. In India the history of labour law is interwoven with the history of British colonialism. End of service gratuity according to Domestic Workers Law.

Shall be deemed to be salary or wages income taxable at the rate declared by Section 12 of the Income Tax Salary or Wages Tax Rates Act 1979. Director General means the Director General of Labour appointed under section 31. According to Article 15 of the Law No.

167 of total gross salary for employers that employ up to nine employees. Other regional groups that are significant trade partners of. Use this number to calculate how much the employee is paid daily monthly salaryworking days in a month.

Enter the email address you signed up with and well email you a reset link. 067 to 333 of total gross salary for employers that employ more than nine employees the precise rate depends on the business sector. Labour is at the end of this road it must reclaim social material justice as its central task or go to the wall.

9th September 2010 From Malaysia Kuala Lumpur Attached Files Download Requires Membership 019 - Permit To Workpdf 6308 KB 3933 views Kesava Pillai. A professional degree in this discipline can take your career to the next level. Evolution of Labour Law in India.

Ali earned RM 2000 a month and took 4 days of unpaid leave in September 2020. According to the Labor Law maximum. Use a private browsing window to sign in.

Dear Friends I am watching the deliberations eagerly.

Malaysia S New Minimum Wage To Take Effect From 1 May 2022 What Employers Should Note

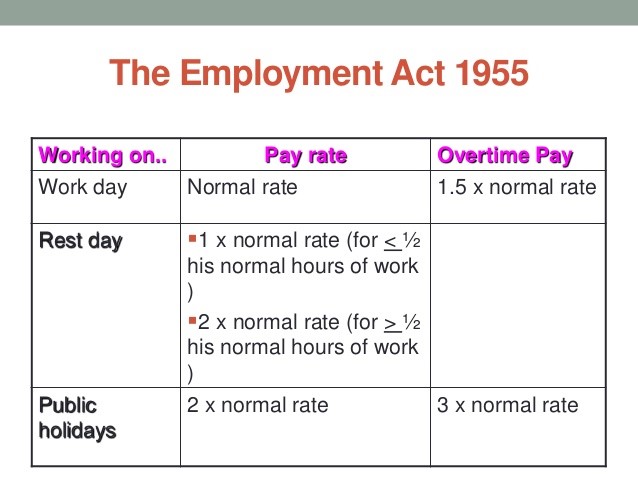

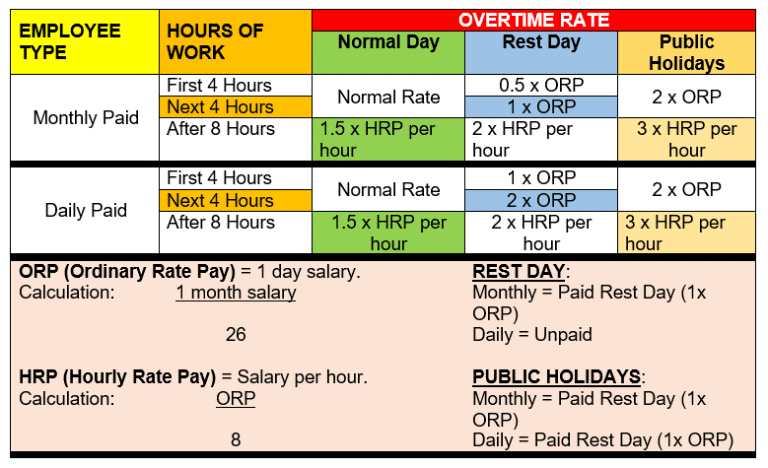

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

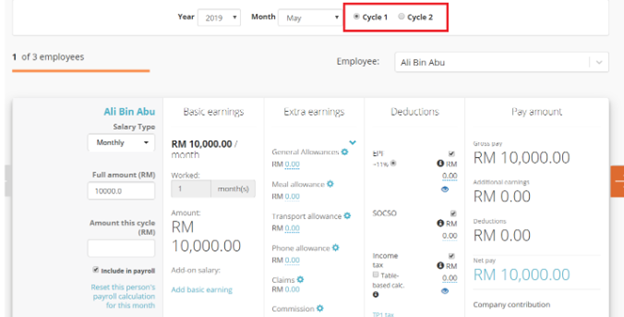

Labour Law Malaysia Salary Calculation Madalynngwf

Employment Act 1955 Salary Calculations And Benefits Marm

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Everything You Need To Know About Running Payroll In Malaysia

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Everything You Need To Know About Running Payroll In Malaysia